2012 OPERATING REVIEW

In many ways, 2012 was a banner year for Kimco. We delivered outstanding results, while improving the quality, value and growth potential of our shopping center portfolio.

Dear Fellow Shareholders and Associates:

In many ways, 2012 was a banner year for Kimco. Focused on both the present and the future, we delivered outstanding financial and operating results, while strengthening our balance sheet and making significant strides toward improving the quality, value and growth potential of our shopping center portfolio for the long term.

Our reported funds from operations (FFO) as adjusted came in at $514.2 million, or $1.26 per diluted share, up 5 percent from $489.8 million, or $1.20 per diluted share, in 2011.

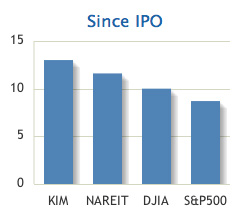

For this solid performance, shareholders were rewarded with a total return of nearly 24 percent, continuing a long history of sector- and market-beating returns enjoyed by Kimco investors (see the chart on the right).

Dividends, of course, make up a significant portion of Kimco’s total return. In October, the Board approved a 10.5 percent increase in our quarterly dividend, to an annualized rate of $0.84 per common share, reflecting our strong results and confidence in our future growth prospects.

In many ways, 2012 was a banner year for Kimco. Focused on both the present and the future, we delivered outstanding financial and operating results, while strengthening our balance sheet and making significant strides toward improving the quality, value and growth potential of our shopping center portfolio for the long term.

Our reported funds from operations (FFO) as adjusted came in at $514.2 million, or $1.26 per diluted share, up 5 percent from $489.8 million, or $1.20 per diluted share, in 2011.

For this solid performance, shareholders were rewarded with a total return of nearly 24 percent, continuing a long history of sector- and market-beating returns enjoyed by Kimco investors (see the chart on the right).

Dividends, of course, make up a significant portion of Kimco’s total return. In October, the Board approved a 10.5 percent increase in our quarterly dividend, to an annualized rate of $0.84 per common share, reflecting our strong results and confidence in our future growth prospects.

Davidson Commons, Charlotte, North Carolina

City Heights, San Diego, California

TOTAL RETURN PERFORMANCE

$100,000 invested at IPO would be worth $1.3 million at December 31, 2012

Source: NAREIT, Bloomberg

Kimco outperformed major indices over a one-year period

Source: NAREIT, Bloomberg

HOME / ABOUT THE COMPANY / SHAREHOLDER INFORMATION / CORPORATE DIRECTORY / DOWNLOADS / SITE MAP

© 2013 Kimco Realty Corporation / kimcorealty.com