Location, demographics, tenant mix and conservative financing are all essential to providing safe and durable cash flows. This is what we are striving for on a daily basis and what an investment in Kimco represents.

Chairman's Letter

Dear Friends and Associates:

Last year, we celebrated the 20th anniversary of our initial public offering. As we enter our third decade as a public company, we feel energized and look forward to the future. Our back-to-basics strategy is well-defined. Our portfolio metrics are strong and continue to improve.

The Operating Review beginning on page 12 will shed light on the details surrounding our performance this year. Before we delve into those specifics, it is worthwhile to take a step back and look at what an investment in Kimco represents on a macro level.

The United States is a growing country. When we went public in 1991, the population in the United States was approximately 253 million people. It is now estimated to be 313 million people. This growth of 60 million people is as much as the combined populations of Canada, Australia and New Zealand. To put this in further perspective, the population of countries such as Japan, Russia and Germany is shrinking. The consistent growth experienced in the United States translates into enormous demand for our shopping center product. At the same time, with virtually no new construction, there is a lack of fresh supply to satisfy that demand. As such, the positive supply-and-demand fundamentals of real estate remain intact in our country and in our sector.

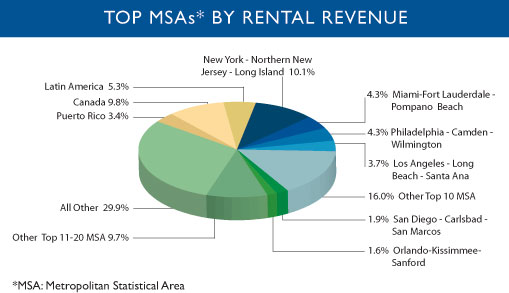

Geographic diversity is another attribute of our U.S. portfolio. Our properties are located in all the major U.S. population centers and are contiguous to major highways and thoroughfares; approximately one-third of our annualized base rent (ABR) is generated from the 10 most populated Metropolitan Statistical Areas (MSAs) in the U.S. Our largest exposure, which generates approximately 10 percent of our ABR, is the No. 1 population center in the United States, namely the New York – Northern New Jersey – Long Island MSA, which is also our home market.

Within our combined portfolios in the U.S., Canada and Mexico, we carefully manage our exposure to individual retailers. Our tenant diversity is broad, with the largest tenant representing only 3 percent of our ABR. Our top 25 tenants represent about 32 percent of our ABR.

Our three largest retailers in 1991 were Kmart, TJX Companies and Kohl’s, which represented approximately 6.6 percent, 5.1 percent and 4.5 percent, respectively, of our ABR. Today, our exposure to the top three is about half of what it was 20 years ago: Home Depot (3.0 percent of ABR), TJX Companies (2.9 percent) and Walmart (2.5 percent).

Yes, retailers will come and go. Throughout our 50-year history, we have managed to operate and grow even under the most challenging of economic environments.

Location, demographics, tenant mix and conservative financing are all essential to providing safe and durable cash flows. This is what we are striving for on a daily basis and what an investment in Kimco represents. To be able to navigate through all cycles, it is essential to have a highly skilled management team. In this regard, our expertise and excellence is second to none in the industry. I am thankful to Dave Henry, who currently also chairs the International Council of Shopping Centers, and Mike Pappagallo and Glenn Cohen for their immense contributions. We are grateful to all of our associates, investors and retailer friends for making Kimco what it is today.

We look forward to moving into the next 20 years with the clear mandate, as always, to create value for our shareholders.

Milton Cooper

Executive Chairman

The Operating Review beginning on page 12 will shed light on the details surrounding our performance this year. Before we delve into those specifics, it is worthwhile to take a step back and look at what an investment in Kimco represents on a macro level.

The United States is a growing country. When we went public in 1991, the population in the United States was approximately 253 million people. It is now estimated to be 313 million people. This growth of 60 million people is as much as the combined populations of Canada, Australia and New Zealand. To put this in further perspective, the population of countries such as Japan, Russia and Germany is shrinking. The consistent growth experienced in the United States translates into enormous demand for our shopping center product. At the same time, with virtually no new construction, there is a lack of fresh supply to satisfy that demand. As such, the positive supply-and-demand fundamentals of real estate remain intact in our country and in our sector.

Geographic diversity is another attribute of our U.S. portfolio. Our properties are located in all the major U.S. population centers and are contiguous to major highways and thoroughfares; approximately one-third of our annualized base rent (ABR) is generated from the 10 most populated Metropolitan Statistical Areas (MSAs) in the U.S. Our largest exposure, which generates approximately 10 percent of our ABR, is the No. 1 population center in the United States, namely the New York – Northern New Jersey – Long Island MSA, which is also our home market.

Within our combined portfolios in the U.S., Canada and Mexico, we carefully manage our exposure to individual retailers. Our tenant diversity is broad, with the largest tenant representing only 3 percent of our ABR. Our top 25 tenants represent about 32 percent of our ABR.

Our three largest retailers in 1991 were Kmart, TJX Companies and Kohl’s, which represented approximately 6.6 percent, 5.1 percent and 4.5 percent, respectively, of our ABR. Today, our exposure to the top three is about half of what it was 20 years ago: Home Depot (3.0 percent of ABR), TJX Companies (2.9 percent) and Walmart (2.5 percent).

Yes, retailers will come and go. Throughout our 50-year history, we have managed to operate and grow even under the most challenging of economic environments.

Location, demographics, tenant mix and conservative financing are all essential to providing safe and durable cash flows. This is what we are striving for on a daily basis and what an investment in Kimco represents. To be able to navigate through all cycles, it is essential to have a highly skilled management team. In this regard, our expertise and excellence is second to none in the industry. I am thankful to Dave Henry, who currently also chairs the International Council of Shopping Centers, and Mike Pappagallo and Glenn Cohen for their immense contributions. We are grateful to all of our associates, investors and retailer friends for making Kimco what it is today.

We look forward to moving into the next 20 years with the clear mandate, as always, to create value for our shareholders.

Milton Cooper

Executive Chairman